A BOLD GIVING INITIATIVE: Alfanar

TRANSFORMING LIVESTHROUGH VENTURE PHILANTHROPY

introduction

Alfanar is a venture philanthropy organization that provides funding, along with the necessary management and planning supports, to promising social enterprises that are addressing critical social issues. Its goal is to help those organizations grow and sustain their impact over the long term.Why bold

Alfanar is the first venture philanthropy organization in the Arab region, and one of the only entities to provide both financial and nonfinancial support to help promising, growth-stage social enterprises become financially and operationally sustainable.the details

Apply all assets

Apply and adapt business sector approaches

DEFINE CLEAR GOALS

Identify “opportunity gaps” in the sector, where your support can have the greatest impact

BUILD CAPABILITIES

Build organizations’ capacity to grow, in addition to providing funding

LEARN AND EVOLVE

Invest in tools and guidance to evaluate impact

Founder, and Chair Tarek Ben Halim, Lubna S. Olayan

established 2004

Primary Focus Education, youth employment, and women's economic empowerment

geography Egypt, Lebanon, Jordan, and refugee communities

FAST FACTS

THE OPPORTUNITY FOR IMPACT

Tarek Ben Halim, a London-based investment banker of Palestinian and Libyan descent, once characterized himself as “a very nationalistic Arab and very proud of Arab history.” Although he deeply loved his homeland of Libya, images of destitution from the region stayed with him. The extreme rates of infant mortality and illiteracy among women. The children laboring in Egyptian quarries, deprived of education and a pathway out of poverty. The gravity-defying rise in unemployment among young people, and the deep malaise in far too many communities

Despite those dispiriting realities, Ben Halim embraced the notion that “everyone has potential,” even as he conceded, “not everyone has a chance.” He argued that far too little was being done to address the great need. His conclusion: he and other successful Arab entrepreneurs had a responsibility to help the region’s most marginalized people build a brighter future for themselves and their children.

In 2000, Ben Halim acted. He resigned from his successful banking career, vowing to put his skills to work in the social sector. He would do this by supporting organizations that were devoted to “transforming lives in deprived communities” across the Arab region. But how to proceed?

Ben Halim knew that many small social enterprises — both for-profit and nonprofit — bring innovative approaches to address the region’s challenges. Some, like Inaash, which serves Palestinian refugee camps in Lebanon, are creating employment opportunities for refugee women. Others seek to better educate underprivileged students, as Educate Me does in Cairo’s slums.

He also knew that all too often, these ambitious organizations lacked the capital and capabilities to grow sustainably. To graduate from the start-up phase, they needed long-term funding and management guidance. However, both of these supports were in critically short supply in the Arab region’s nascent social enterprise sector in 2004.

At the same time, the global business sector was becoming increasingly adept at scaling growth-stage companies, with venture capital firms providing them with risk capital and management support. In the United States, philanthropists were increasingly using these venture capital techniques — a practice called “venture philanthropy” — to help position more up-and-coming social enterprises for long-term success.

Ben Halim decided to bring this venture philanthropy approach to the Arab region. His logic: if Alfanar could provide the funding, training and management support to help local social enterprises grow their impact sustainably, they could empower communities to solve their toughest problems long after Alfanar's investment exit.

"I’m not sure it will succeed, but Alfanar is a risk worth taking."

Tarek Ben HalimAlfanar founder

A BOLD INVESTMENT IN VENTURE PHILANTHROPY

IN THE ARAB REGION

In 2004, Ben Halim founded Alfanar, the region’s first venture philanthropy firm. “I’m not sure if it will succeed,” he said, “but Alfanar is a risk worth taking.”

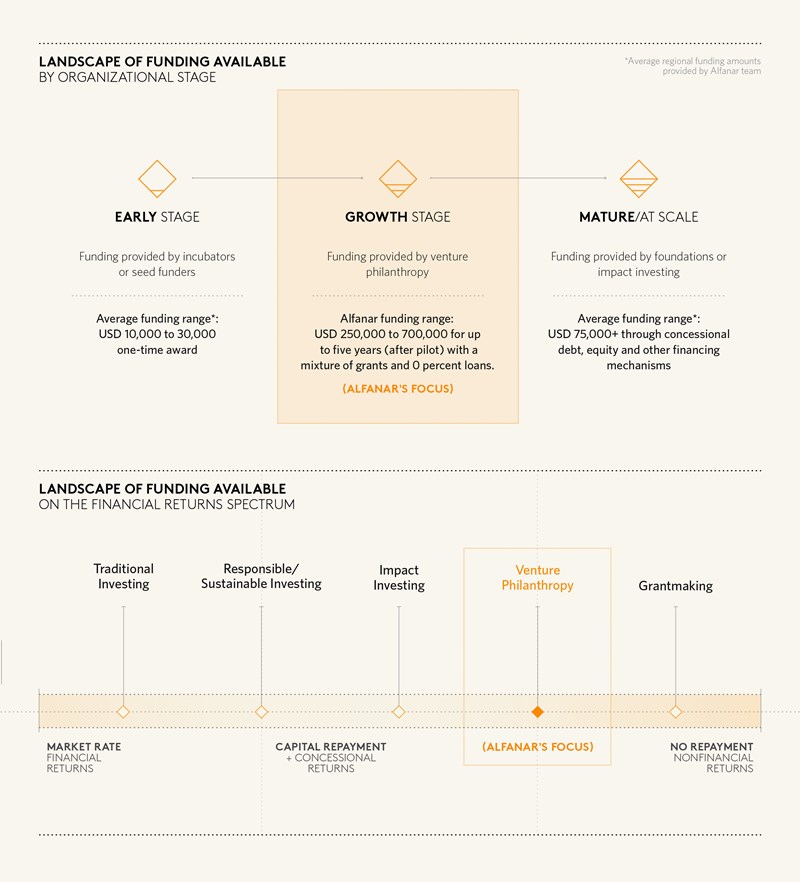

Alfanar’s approach breaks from the status quo in three important ways. First, rather than add to the sizable pools of funding for early-stage efforts and mature organizations, Alfanar addresses the funding gap for organizations in between those life stages. It targets growth-stage social enterprises that have pushed past the start-up phase and demonstrated some success, but still need help in extending their reach. To match their funding needs, Alfanar commits to making larger multi-year, flexible investments.

Second, rather than operate at the well-addressed ends of the financial returns spectrum — which ranges from no-repayment grants to investments with return expectations — Alfanar targets the gap in between. It refrains from obligating the social enterprises to deliver a financial return, so they have the flexibility to invest in themselves. At the same time, Alfanar does offer partially repayable grants.

“We want to train them to repay a portion of the funding, and to be ready for loans or for equity investments after we exit,” explains Michelle Mouracade, head of Alfanar Lebanon. Alfanar also opts to call the organizations that it funds “investees,” to encourage a mindset of developing revenue-generating models for longer-term sustainability.

Third, unlike many of the region’s funders, Alfanar provides non-financial support. Ben Halim believed that helping investees with strategy, operations, and measurement would amplify their ability to deliver sustained and scalable impact.

“Tarek knew that funding is necessary but not sufficient for change,” says Myrna Atalla, Alfanar’s executive director. “The real glue to venture philanthropy is active management support.”

For every USD1 in funding, Alfanar adds USD0.42 in management support to each social enterprise, she notes.

With this vision in place, Alfanar set about testing its approach in Egypt, where the need was great — especially in fields such as education and women’s economic empowerment — and the relatively stable environment was conducive to venture philanthropy. The country also had a sufficient number of growth-stage social enterprises that were making an impact and demonstrating the potential to scale, and so would likely benefit from Alfanar’s model.

Even with these promising indicators, Ben Halim knew it would take a coordinated effort to confront the region’s vast, deep-rooted social development needs. In addition to launching Alfanar with his personal funds, he reached into his network to recruit people with diverse expertise, to serve as founding board members.

In 2009, five years after he launched Alfanar, Ben Halim tragically died from a brain tumour at the age of 54. Friends and family came together in his memory to affirm their belief in the sustainable impact movement he had launched. His vision and early success convinced Alfanar’s board that its approach was worth pursuing.

Under the leadership of its chair Lubna S. Olayan, the board committed to growing and professionalizing the organization, and — in the decade since Ben Halim’s passing — Alfanar has evolved to become a regional leader in the philanthropy and social enterprise space. Today, it has a diversified donor-investor pool comprising more than 2,000 individuals, corporates and institutions, who support Alfanar’s investments either through unrestricted funding or by giving to specific investees (restricted funding).

“Alfanar’s vision has remained constant, to enable the poor and vulnerable to access the education and opportunity they need to lead productive and dignified lives,” notes Olayan, who has given significantly of her own time, energy, and philanthropy to the platform. The board provides vital support to Alfanar's efforts, covering the organization's overhead costs.

With this support and the management team’s guidance, Alfanar has built its portfolio in Egypt and expanded to Lebanon, a country that also was a strong fit for Alfanar’s model. To date, it has invested around USD 7 million in 35 social enterprises.

These organizations, in part enabled by Alfanar’s support, have touched the lives of some 68,217 disadvantaged people across Egypt and Lebanon. Looking ahead, Alfanar plans to help strengthen social enterprises across the Arab world and reach 500,000 people in the coming five years.

Examples of Alfanar’s Investees

- ShareQ’s M Social Catering provides culinary training and jobs to low-income women and youth in Lebanon and runs a catering operation to generate revenue to support its work. Alfanar helped M Social develop a business plan for a for-profit entity to sell hummus cups, and advised it to spin-off its training arm into a nonprofit. It also provided funding for the initial investments in equipment and staff, and continued supporting the business’ efforts to increase revenue and improve operational efficiency. Since 2015, ShareQ has trained and helped to employ 1,333 women, youth and disabled people. With Alfanar's support, ShareQ grew its impact by 1,020 percent and it recovers a third of its costs through self-generated revenue.

- Future Eve Foundation (FEF) supports widows and female breadwinners, especially in Egypt’s poor rural communities. Since 2012, Alfanar has backed FEF’s Amal Project, which provides vocational and financial literacy training, along with microloans and additional supports to start small businesses. Alfanar helped FEF develop a business plan to expand this work, aided in designing a pilot program (on developing value chains around certain products), connected the team with experts to assist with topics such as accounting, and brought them on a study mission to Bangladesh to meet best-in-class microfinance institutions and social enterprises. Since 2012, Alfanar's investment and management support has enabled FEF to reach nearly 15,000 widows and female-led households across Minya, Beni Suef, and Alexandria. On average, the Amal Project enables widows to increase their take-home income by 33 percent. This investment is now financially sustainable.

- Educate Me is an ambitious and innovative education-focused social enterprise located in Egypt. When Alfanar began its investment in 2015, the initiative was an informal after-school program and, as such, a risky venture. Today, following investment from Alfanar, it is not only a registered community school serving 288 children every year, but it is also scaling its impact. Through professional development training for educators across Egypt, it is raising the quality of education delivered across 152 public schools in nine governorates, and reaching 5,000 educators or 45,000 children. Educate Me recovers 65 percent of its costs through the sale of its training support.

HOW THE INITIATIVE WORKS

Selecting investees

Alfanar looks to identify growth-stage social enterprises with the potential to drive social impact and become financially sustainable. It seeks to add two to three investees per year in each country. To qualify, the applicant must have been registered — as a nonprofit or for-profit — and have a proof of concept that is ready for growth capital. Applicants must also pass standard background checks and due diligence, before being presented to Alfanar’s investment committee and board.

A number of factors are tested, including the organization’s commitment to serving disadvantaged communities, a revenue model that ensures its sustainability, a desire to grow, and a strong leadership team. Importantly, Alfanar also tests the organization’s openness to receiving management support. Over a period of one to three months, Alfanar meets with the organization’s leadership team and board, interviews its suppliers and constituents, and reviews its audited financials.

“We are trying to track whether they understand their objectives, are structured around impact, have demonstrated the potential of their model, [and] are capable of generating revenue reliably,” says Atalla.

Investing for the long term

Once Alfanar has identified an investee, it provides a year-long pilot investment of up to USD 45,000 to test the organization’s capacity to grow and sustain its operations. During that year, the investee seeks to demonstrate that it can reach a set of agreed-upon performance metrics and targets, such as those around reach (number of students receiving courses), outcomes (number of women employed and their take-home income), and cost recovery. If this process reveals that an organization’s business model is unlikely to be financially viable and it will rely on fundraising to sustain it, Alfanar will exit.

Yet for most investees, Alfanar will then commit to a longer-term social investment. The agreed upon timeframe — typically a three-year duration, and up to five years — is based on business plan projections. Over the course of this partnership, Alfanar provides funding of between USD 250,000 and 700,000. By committing to multiple years of support, Alfanar provides its investees with the flexibility to think big, plan for the long term, and take calculated risks.

“People keep saying to these organizations ‘Think bold, think long term,’” says Atalla. “But if they don't know somebody is going to back them, how are they to do that?”

Providing hands-on support

Alfanar’s nonfinancial supports help strengthen investees’ capabilities and set them on a path to sustainability. As Shenouda Bissada, head of Alfanar Egypt, explains: “Many of the organizations that we select do not yet have management structures and plans in place.”

To address these needs, Alfanar provides a set of foundational supports to each investee: business planning and execution, management support, and impact measurement.

In 2015, it launched the Alfanar Sustainable Social Enterprise Training (ASSET) program, which offers 12 training modules on both business and social entrepreneurship topics. Alfanar also layers on customized supports to meet each investee’s specific needs, including connections to expert advisors, study trips to best-in-class enterprises from across other developing countries (such as BRAC’s poverty-alleviation programs in Bangladesh), and tools and technology.

A team of 15 full-time staff across Egypt, Lebanon, Jordan and the United Kingdom provides these deep supports, with each investment officer covering four investees. The standardized training curriculum and strong network of volunteer experts help Alfanar to keep this team relatively small, while still ensuring investees receive rich supports.

Tracking progress

Seeking to understand whether its efforts are driving results and to identify opportunities to improve, Alfanar monitors investees’ progress and its own performance.

Investees report on a quarterly basis, with measures spanning social impact, the ability to generate revenue, and progress in establishing strong internal systems and processes. Each of these activities is measured against defined targets. Alfanar develops social impact and financial sustainability tracking applications for each investee and gives them access to Qlik, an online business intelligence software that helps them collect, monitor, and analyze data on an ongoing basis.

Based on what they learn from these measures, Alfanar works with investees to make evidence-based decisions about strategy, adjusts their targets if necessary, and identify any additional supports they will need.

“What we're trying to do is transform reporting from being a chore,” says Atalla. “We want investees to experience it as a source of power that helps them make better management decisions.”

To foster its own learning and improvement, Alfanar asks investees to complete an anonymous survey twice a year. Investees often offer positive feedback, noting how the Alfanar team’s nonfinancial support helps to improve their performance. There is also constructive feedback. For instance, responses about the lengthy due diligence process led Alfanar to reconsider and streamline its approach.

Alfanar’s Due Diligence Process

A process taking up to three months seeks inputs to answer a set of 40-60 questions that covers the following areas:

- Social impact assessment

- Governance assessment

- Financial management review

- Staff management assessment

- Donors' review

PROGRESS AND RESULTS

Achieving results

Alfanar has worked with 35 social enterprises in Egypt and Lebanon since its inception, reaching more than 68,000 people across the two countries. Women lead close to two-thirds of these investees.

Alfanar is currently working with 23 organizations and it has “exited” 13 investees. Most were planned exits, in accordance with the agreed-upon investment cycle.

Alfanar has seen marked improvements in these social enterprises over time, in terms of their reach, impact, revenue generation, and overall business operations (see “Examples of Alfanar’s investees”). On average, investees reach 35 percent more people and generate 39 percent more revenue over the course of Alfanar’s investment as a result of the support.

Take Ana Aqra Association, a teacher training program. With Alfanar’s guidance, it is transforming into a revenue-generating social enterprise with tested education products and services that will help sustain its impact in schools (see “Transformational support: Ana Aqra Association").

Alfanar has also helped Nafham, an online education platform, to improve its offerings. It has made critical updates to its user interface to advance the students’ learning experience, based on findings from an assessment of its learning outcomes.

Underscoring the value of the partnership, Nafham research and assessment consultant, Yumna Saleh, says: “We went through the assessment process together. The Alfanar team suggested many steps during the process and were very engaged when it came to the results and lessons learned. This process was one-of-a-kind.”

Navigating challenges

Despite its overall progress, Alfanar has had a range of experiences with investees across the full portfolio. Not all investees have been able to reach their initial targets within the three-to-five year, post-pilot funding period. This is especially true of organizations working with refugees, given the complex circumstances and legal environment in which they operate.

Alfanar recognizes that social entrepreneurs encounter considerable market challenges. For a few investees, it has agreed to extend its financial and hands-on support to over five years in order to give them a longer runway and accompany them during challenging times. In response to Covid-19, for example, Alfanar has extended its financial and hands-on support.

Alfanar has also had to research a large number of organizations to fill its relatively small portfolio. Only a small proportion of its many applicants meet its initial funding criteria: growth-stage social enterprises that are open to management support and prepared to pursue revenue-generating activities

Even with this low yield, the region’s need extends far beyond the size of Alfanar’s portfolio. “There are organizations we want to support, but we do not have enough capacity,” says Mouracade.

To scale its portfolio and reach its new strategic goal of improving 500,000 lives in the coming five years, Alfanar is working to diversify and build its fundraising capabilities.

To this end, it seeks to build more long-term partnerships like the one it has with SODIC, a real estate company in Egypt, which has backed a portfolio of social investments that reaches over 20,000 people. Alfanar is also sharing its value proposition with aid organizations, foundations, and impact investors who are interested in funding social enterprises that demonstrate the potential to stand on their own.

Moving forward

Looking ahead, Alfanar is exploring ways it can create impact beyond its portfolio. For example, it is looking into opportunities to share its ASSET training on a public platform, as there are few other available training options in the region.

“It would be a waste to just give it to the organizations in our portfolio,” Mouracade shares. “We want to try to reach as many as possible with this training, to give them ideas, to help them be more sustainable.”

It is also exploring partnerships to expand to new geographies. For example, it is currently delivering its ASSET training to 60 social enterprises across East Amman, Ajloun and Tafileh as part of an EU-funded consortium with Plan International and Jordan-based nonprofit Ruwwad.

Transformational support: Ana Aqra Association

In some of Lebanon’s disadvantaged communities, up to 40 percent of students drop out of school because they cannot read. Since 2009, Ana Aqra Association has worked to help high-risk children in public elementary schools in Lebanon become better readers.

Ana Aqra, which means “I read” in Arabic, advances literacy by helping teachers develop their skills. In its first few years, the NGO provided free-of-charge training programs for teachers. However, it lacked a comprehensive plan to extend its reach to more children and also to become financially sustainable. In 2012, Alfanar began working with Ana Aqra, to help set it on a stronger path.

Alfanar provided Ana Aqra with funding and management support. Together, they designed an expansion approach — one that consolidated the NGO’s curriculum into a comprehensive manual that trainers could use as they worked with teachers, parents, and government officials in Lebanon. Ana Aqra also conducted a market analysis, tested the demand for its services, and developed a new business plan, education kit in Arabic, and social enterprise unit to commercialize its efforts.

In 2014, with Alfanar’s support, Ana Aqra secured its first paid contract to provide teacher training services. The NGO went on to recover all of the social enterprise unit’s start-up costs. To date, Ana Aqra has trained 4,600 teachers, who work with almost 90,000 children in Lebanon. It has also become a leader in the field of teacher training, sharing its approach beyond Lebanon.

Ana Aqra's north star goal is to reach another 3,300 teachers and 250,000 children in Lebanon, and to support NGOs in other countries that are working to improve education.

KEY LEARNINGS FOR PHILANTHROPISTS

Apply all assets

Apply and adapt business sector approaches

Alfanar recognizes the value of bringing business sector rigor to philanthropic investing and made this a core tenet of Alfanar’s model. Over time, Alfanar has developed a formalized, multistage due diligence process to determine whether organizations show early signs of having the potential to grow and sustain their impact over the long term. “There isn't a single organization we work with that doesn't have a formal business plan as a result of our investment, since sustainability is a core pillar of our approach,” says Mouracade.

Ben Halim understood that Alfanar would have to adapt the private sector’s approaches if it was to work in a space where impact matters more than profit. For example, Alfanar prioritizes investees’ “reach within marginalized communities” over their “total reach” metrics.

Define clear goals

Identify “opportunity gaps” in the sector, where your support can have the greatest impact

Alfanar observed a gap in the Arab philanthropic funding landscape: few, if any, donors were providing risk-tolerant capital to social enterprises entering their growth phase. Having seen how venture philanthropy addressed a similar gap in other countries, Ben Halim brought this approach to the Arab region.

Alfanar adopts a clear investee selection process to avoid organizations that are out of scope — including start-ups and mature enterprises — and solely supports growth-stage social enterprises that many other funders ignore. Alfanar also conducts research to surface organizations that would most benefit from its unique funding and support. For example, the Alfanar team in Egypt, with funding from SODIC, recently mapped education-focused organizations that best fit the model.

Build capabilities

Build organizations’ capacity to grow, in addition to providing funding

Alfanar understands that financing comes first, but promising organizations also need support in other vital areas. Alfanar dedicates significant team time in working closely with investees, providing guidance, mentorship, and business planning support, and connecting them to external experts in topics such as accounting and product distribution. Exited investee Nafham's CEO and co-founder Mostafa Farahat attests: “The Alfanar team was very engaged from the beginning. They are partners, not just investors.”

In order to address common areas of capacity-building, Alfanar developed its ASSET program to train investees on a standard set of foundational topics for social entrepreneurs.

Learn and evolve

Invest in tools and guidance to evaluate impact

Core to Alfanar’s model is a belief that monitoring and evaluating leads to greater impact and sustainability. Yet many of the region’s social enterprises are not equipped to conduct their own assessments. As a result, Alfanar provides its investees with tools and guidance to promote monitoring, reporting, and build an evidence base. For example, it equips all investees with customized applications and access to a business technology platform for data gathering and analysis.

Working from impact assessments, Alfanar also helps investees improve program design and implementation, as it did with Nafham to enhance its online learning platform.

About the philanthropists: TAREK BEN HALIM AND LUBNA S. OLAYAN

Overview

TAREK BEN HALIM, OF PALESTINIAN AND LIBYAN DESCENT, lived in the United Kingdom for much of his life. He studied finance at Warwick University and received an MBA from Harvard. He had a successful banking career at JP Morgan, Credit Suisse First Boston, and eventually Goldman Sachs, where he rose to become a managing director. In 2004, he left investment banking to launch Alfanar in order to contribute to the Arab region. Although Ben Halim passed away in 2009, his legacy lives on through Alfanar.

LUBNA S. OLAYAN BECAME THE CHAIR OF ALFANAR following Ben Halim’s death and has led it through significant growth.Saudi- born Olayan is the former CEO — and now board member — of Olayan Financing Company, a subsidiary and the holding entity for the Olayan Group's operations in Saudi Arabia. In 2019, she was named chair of the Saudi British Bank (SAAB), becoming the first Saudi woman to lead a bank. She has been a member of the board of Schlumberger since 2011, and was a board member of Ma’aden, a Saudi public company operating in the mining sector, until 2020.

Olayan also sits on several international advisory boards, including those of Akbank, Allianz SE, McKinsey & Co and Bank of America Merrill Lynch. She is currently a Trustee of the King Abdullah University of Science and Technology, the Massachusetts Institute of Technology, and the Asia Business Council.

APPENDIX: References

For access to the full case study, with references and additional features, click here.

Bold giving initiatives

Philanthropists are catalysts for bold initiatives taking place across the Arab region. Explore below to learn more about the impactful work underway. For details of other notable projects in the region, click here. To access further research and notes on the selection process, click here.

TACKLING HUNGERIN EGYPT

The Egyptian Food Bank launched in 2006 with the goal of wiping out hunger. Today, its innovative approach to food relief and tackling the root causes of hunger has spread to 30 countries worldwide.

Primary philanthropist MOEZ EL SHOHDI

established EFB WAS ESTABLISHED IN 2006; FBRN WAS ESTABLISHED IN 2013

Primary Focus FOOD SECURITY

geography EGYPT AND THE ARAB REGION

View More

CUTTING JORDAN’STRAFFIC DEATHS

The Hikmat Road Safety (HRS) initiative aims to reduce the high number of traffic-related injuries and fatalities in Jordan and bring about lasting change in the road safety system by creating awareness around the issue, developing road safety infrastructure, and changing behaviors of drivers and pedestrians.

Primary philanthropist MAHER KADDOURA

established 2008

Primary Focus ROAD SAFETY

geography JORDAN

View More

DISCOVERING “WHAT WORKS”TO ALLEVIATE POVERTY

The Abdul Latif Jameel Poverty Action Lab (J-PAL) is a global research center working to reduce poverty by ensuring that decisions on scaling programs and shaping policy are informed by rigorous data.

Primary philanthropist THE JAMEEL FAMILY THROUGH COMMUNITY JAMEEL

established 2003; J-PAL MENA ESTABLISHED 2020

Primary Focus Cross-sectoral, including agriculture, crime and conflict, education, employment, environment and energy, financial inclusion, gender, health, political economy, and humanitarian assistance

geography Research conducted in 86 countries, including nine Arab countries (Egypt, Jordan, Iraq, Morocco, Qatar, Saudi Arabia, Tunisia, Lebanon, and Yemen). Global office at the Massachusetts Institute for Technology (MIT) in the US, and seven regional offices: Africa, Europe, Latin America and Caribbean, North America, South Asia, Southeast Asia, and Middle East and North Africa

View More